Why The UK?

Why The UK?

STRONG ECONOMY

USD 2.8 Trillion GDP

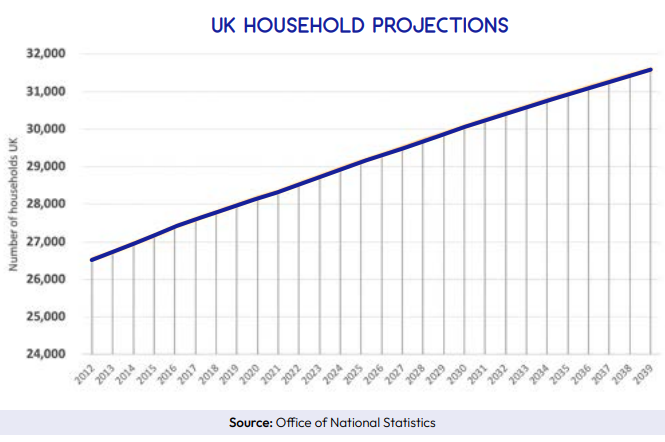

GROWING POPULATION

68 million expected to grow by 6-8 million in the next 15 year

MAJOR HOUSING BACKLOG

4.75 Million units

1. How Land Is Used.

The UK has limited land available for construction due to the vast green areas that are protected which has resulted in its scarcity, driving up its value.

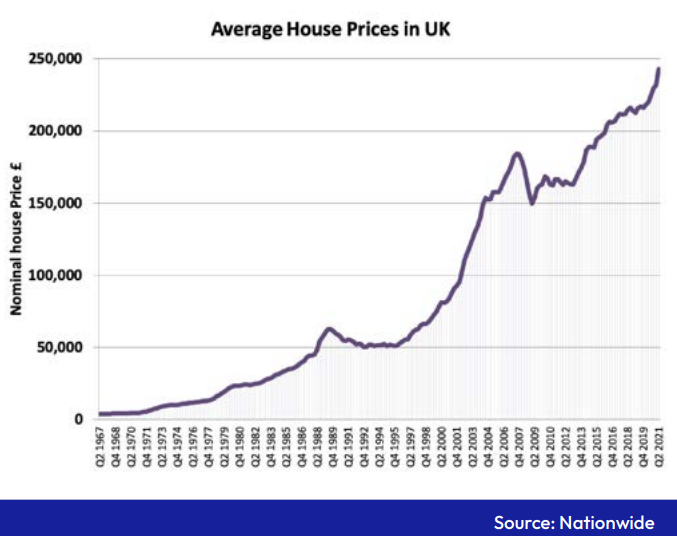

2. Capital Growth

3. Supply Vs Demand

The UK is facing a severe housing crisis, with a backlog of unfulfilled demand for new homes that the government has failed to meet. As the population continues to grow, the lack of available housing will continue if not increase. The shortage is projected to exceed 100,000 properties annually over the next decade, resulting in a shortfall of one million homes by 2025. This scarcity is driving up property prices throughout the country.

‘According to the Office of National Statistics there will be an annual shortage of housing in the UK of over 100,000 properties each year for the next decade. This could mean a 1 million housing shortfall by 2025 if current trends continue’

4. Rental Demand

The rental market in the UK is experiencing a high demand due to various cultural and demographic shifts. With the average age for buying a property being 44, people are renting for extended periods.

There are several reasons for this demand, including a large and growing student population, young adults getting married or starting families later in life, older people looking to downsize, an increase in immigrants, and more people living alone due to divorce rates. Additionally, the ongoing regeneration of cities creates a need for employment and housing, adding to the demand. As a result, rental properties located correctly are being let extremely quickly, and rental income is steadily increasing.

The high demand for rental properties is also due to rising house prices, which makes it difficult for first-time buyers to enter the market. With this trend set to continue, it is likely to remain highly competitive, offering a potentially lucrative opportunity for property investors.

5. Confidence

The UK has long been considered an economic powerhouse, with the real estate market being an integral part of this reputation. Despite various external factors, confidence in the UK market remains high, fuelling the housing industry. Both local and foreign investors are keen to invest in and grow their assets due to the strength and reliability of the UK currency and legal system.

The country’s reputation for stability, opportunity, and security is well known and respected, making it an attractive prospect for investors. The UK’s longstanding reputation as a reliable and secure investment destination is a significant factor in driving the continued demand for real estate, making it a stable and profitable investment opportunity.